Table of Contents

ToggleCredit Score Management

Credit Score Management

In this digital age, where everything is done online, your financial actions are also being watched and categorized by your credit score, which is based on how well you can pay back debts and your credit history. So, you need to keep an eye on your credit score. This is very important when you are trying to find loans, mortgages, and the best interest rates. You should take care of your money well and have a good credit score. It might even help you save money on interest.

The methods in this guide are all very detailed and will help you get and keep a good credit score.

What does a credit score really mean?

Your credit score is a number that shows how creditworthy you are based on your credit history. Companies that lend money often use it to figure out how risky it might be to give you money. Higher numbers mean that you have a good credit history. Scores can be between 300 and 850. Your credit score is affected by many things, such as how well you’ve paid your bills in the past, how long you’ve had credit, any new credit you’ve gotten, and the types of credit you’ve used.

When did credit reports start being made?

An amazing change has happened in the world of credit reports. It started out small and localized, but now it’s a huge global business that helps people make important financial decisions. This change happened because of new technology, rules, and business needs. These changes have affected not only lending practices but also customer behavior and the economy as a whole.

It is very important to understand the historical background.

Credit reporting began with small, local organizations in the middle of the 20th century. These organizations gathered basic information about customers to help small businesses handle credit risks. These companies mostly gathered bad information, like late payments and missed payments, by checking public records and newspapers for personal details that could affect creditworthiness, like marital status or legal problems.

Changing to more up-to-date credit reporting

Because of new technologies and changes in the rules in the 1970s, this system went through a big change. A big change happened when the Fair Credit Reporting Act (FCRA) of 1970 set rules for making sure that credit information was correct and protecting people’s rights. Together with the development of computers, these improvements made it easier to store and process data. In the end, this led to credit reports being centralized into national organizations that kept complete, accurate, and complete credit histories.

Why credit reporting agencies are important in today’s financial world

Credit reporting companies like TransUnion, Equifax, and Experian have a big effect on the world of money. Lenders need them to figure out how risky it is to give money to someone, and they can also be used to make product development and strategic decisions in the financial industry. This information is very important for figuring out how financially stable customers are and whether they can pay their bills.

Framework for regulations

The Fair Credit Reporting Act (FCRA) is still an important part of credit reporting because it makes sure that information is used fairly and accurately. People can look over their credit reports and dispute any mistakes they find. This shows that credit reporting processes are becoming more open and protecting people’s rights.

What it means for businesses and consumers ?

Credit reporting has a big effect on many parts of a person’s financial life. For consumers, having a good credit past is important because it lets them get loans at reasonable rates. In the same way, companies depend on detailed credit reports to manage and lower the risks that come with lending money. It boosts economic activity by making it easier to make faster and more accurate decisions about who is creditworthy.

Looking ahead to the future

Even though the industry is always changing, worries about data security and privacy are still at the forefront of new rules and technologies. The ongoing shift to digital has a lot of potential to make it easier to gather, analyze, and use credit data. It’s clear that credit reporting companies will continue to play a big part in shaping the economy.

In a credit report, what kinds of things are usually found?

Your name, address, and Social Security number are all important pieces of personal information that are found on your credit report. It also has information about the loans you’ve taken out, like loan applications, debts that are still open, and your payment records.

In addition, the report might have information like your old addresses, date of birth, and jobs. Even though this information is very detailed, credit report mistakes still happen a lot, especially for people with common last names.

The most important part of your credit report talks about all of your recent financial actions, including

- Credit searches are checks that lenders do on you when you apply for credit.

- Information about loans: List any loans you have, including the name of the bank, the amount of the loan, the date it was opened, the amount you pay each month, and a history of payments.

- Start with accounts that you can use over and over, like credit cards. The report will show information like the bank that issued the card, the credit limit, the date the card was opened, a history of payments, and the amount at the end of the billing cycle.

- Closed accounts: Information about any accounts you’ve closed will stay on your credit report for up to seven years.

- There are also collections accounts. If a bill, like a hospital bill, is sent to a collection’s agency, it will show up on your report.

- Public records: These are things like tax liens, court orders, and bankruptcy files.

- Comments: You and your creditors can post comments in your report to give more information about certain records.

- Lenders can figure out if you’re a good credit risk by looking at how you handle your money. They then decide if they want to lend you money.

How do credit scores get calculated?

Credit scores are found by using complicated mathematical formulas.

Important parts include for a good credit score are:

- Payment History: Loan and credit card payments are always made on time.

- Credit Usage: The amount due, which is based on how much credit has been used compared to how much credit has been available.

- Having a longer credit background is better.

- New Credit: If you apply for credit a lot, your score may go down for a short time.

- Diverse Credit Portfolio: Having different types of credit, like credit cards and mortgages.

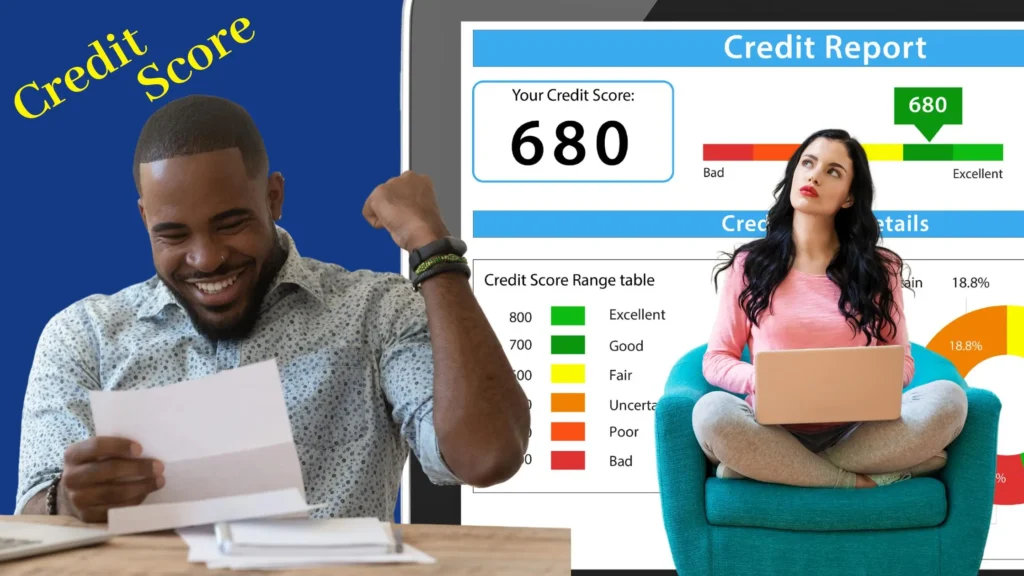

What Does It Mean to Have a “Good” Credit Score?

A good credit score is usually between the mid-600s and the high-600s.

This is how FICO sorts scores:

- Outstanding (800+): Low risk, quick loan approvals.

- Excellent (740–799): Rates are good, but they’re not sure.

- It’s where most Americans fall, between 670 and 739.

- Fair (580–669): these are subprime loans with high interest rates.

- Poor (579 or less): This group is seen as high risk and has few credit choices.

How can I get a free copy of my credit report?

Credit scores are free on sites like Credit Karma, WalletHub, and Experian. It doesn’t change your scores if you check your own credit.

How can I raise my credit score?

If you want to raise your credit score, you need to make a well-thought-out plan. The important thing is to manage credit responsibly over a long length of time. To raise and keep your credit score high, here are some useful things you can do:

Check your credit reports often.

If there are mistakes on your credit report, it can hurt your credit score. Every year, go to AnnualCreditReport.com to get a free credit report from Equifax, TransUnion, and Experian, the three main credit organizations. Carefully look over your reports for any indications of fraud or discrepancies, and if you find any, follow the right steps to make a dispute. Making sure that your credit report is correct is very important if you want to keep your credit score high.

Make sure bills are paid on time.

Your payment history is a big part of your credit score; it makes up 35% of your FICO score. Making sure you pay all of your bills on time is very important because any delays could hurt your credit score. You could use a calendar to remind you of payments or set up regular payments to make sure you never miss one.

Lower the amount of credit you’re using.

The main thing that affects your credit score is credit usage, which means how much you use your available credit. A utilization rate of about 30% of your overall credit limits is a good goal, but lower is always better. You can improve your utilization by doing sensible things with your money, like keeping your credit card balances low and paying your bills on time.

Use your loan wisely.

Taking care of your present debts well can help your credit score go up. Pay off your high-interest debts first, and think about using the avalanche or snowball methods to get out of debt. Putting all of your debts into one loan with a lower interest rate can be a good idea if you have good credit. This can help you handle your debt better and pay it off faster. Read the following blogpost for maintaining a good loan portfolio.

Bank Loan : A Comprehensive Guide to Obtaining a Bank Loan

Limit the number of new credit applications

When you apply for credit, a hard search is made, which could cause your credit score to drop a little. Don’t apply for too many new credit cards at once, especially in a short amount of time. To keep the effects of repeated inquiries to a minimum, it is best to compare mortgage or auto loan rates between 14 and 45 days.

Keep the credit cards you already have open.

The length of your credit history is a big part of your credit score, since credit records that are longer tend to be better. If you don’t use your old credit cards very often, it’s best to keep them open so you don’t have to pay any annual fees. If you keep doing this, the average age of your credit accounts may go up.

Change the way your credit is grouped.

Getting mortgages, credit cards, auto loans, and school loans are all types of credit that can help you improve your credit score. You have shown that you know how to carefully handle different kinds of credit. You might want to open new accounts, but keep in mind that adding to your credit mix won’t have a big effect on your score by itself.

What makes my credit report what it is?

- Elements that have a big effect:

- Be smart about how you use credit cards by keeping your utilization rate below 30%.

- Along with credit mix, credit age, and new credit, payment history is another important thing to think about. It is very important to always pay your bills on time.

- How can I raise my credit score quickly?

- Make sure that bills are paid on time.

- Pay down your credit card debt.

- You should try not to make too many new accounts.

If I check my credit score, what bad things might happen?

There will be no change to your credit score if you do a soft check on your own report.

Putting the above tips into action can help raise your credit score. It is important to follow these steps if you want to improve your credit score.

How often is it suggested that I check my credit report?

You should keep a close eye on your credit, especially before you buy something big.

What’s the Difference Between a Credit Report and a Credit Score?

A credit score turns the information in your credit report into a number. A credit report gives you a full summary of your credit history.

Why does it seem like my credit score has gone down for no reason?

Your credit score can be affected by things like late payments, more debt, or recent credit searches.

How long does it usually take for bad things to show up on my credit report?

Records of most bad information, like late payments and fines, are usually kept for seven years.

In most cases, bankruptcy lasts for ten years.

I have bad credit. Is it still possible to get a loan or credit card?

Prices may be higher, and there may not be as many options.

What changes my credit score when I use different kinds of loans?

Your credit score can go up if you use different types of credit, like loans and credit cards.

Learning About the Things That Affect My Credit Score

Keeping the usage rate below 30% is thought to be good.

What is the effect of late fees on my credit score?

Your score is badly affected by late payments.

Remember that building good credit requires patience, but practicing responsible money management is worth it.

What credit score do I need to apply for the Amex Gold Credit Card?

The American Express Gold Card is a great option for individuals who love dining out. It offers rewards for purchases made at restaurants and grocery shops, as well as extra benefits such as dining credits and Uber Cash. If you’re considering getting this card, here’s what you should know about the credit score requirements:

To be eligible for the Amex Gold Card, a good to excellent credit score is typically needed. However, American Express does not reveal the exact credit score needed. Typically, a score of 670 or higher is needed.

Pre-Qualification:

American Express offers a convenient tool that allows you to assess your eligibility for the card without any bad impact on your credit score. It was launched in 2022 as ‘apply with confidence’. By completing a form, you can determine your likelihood of approval through a soft credit check, which has no effect on your credit score. Link of the same is mentioned below:-

Gaining Insight into the Significance of Dun & Bradstreet Credit Reports in Business Decision-Making

In today’s fast-paced business world, having access to accurate and thorough data is absolutely important when it comes to making well-informed credit decisions. As a prominent global provider of business analytics and data, Dun & Bradstreet offers credit reports that are important tools for credit professionals in various industries. These reports offer valuable insights into a company’s creditworthiness and help ease risk management and informed decision-making.

Important Elements of a Dun & Bradstreet Credit Report

1.Study of projected financial behaviour:

At the heart of Dun & Bradstreet’s credit reports are the predictive scores, such as the PAYDEX® and Delinquency Score, which provide insights into a company’s past and projected financial behaviour. The PAYDEX® Score evaluates a company’s payment performance using historical transactions, while the Delinquency Score forecasts the chance of future late payments. These scores are crucial for lenders and creditors to assess the amount of risk and financial stability of a company.

Thorough Business Profile:

Every credit report offers an extensive company profile, encompassing the business’s financial details, trade payments, size, and operational history. This profile offers a comprehensive perspective on a company, allowing credit professionals to gain a better understanding of its organizational structure and market dynamics.

Assessing Risk:

Dun & Bradstreet’s reports provide an Overall Business Risk score and a Maximum Credit Recommendation, which show the appropriate amount of risk and credit that should be considered for the business. These evaluations assist creditors in determining the appropriate amount of financial risk involved with a potential or current client.

Comprehensive Trade Risk Analysis:

This part provides a thorough examination of a company’s trade payment behaviours and patterns, drawing from a vast database of over 1.5 billion commercial trade experiences to offer a detailed view of the company’s financial engagements. This insight is especially useful for evaluating the company’s ability to consistently meet its financial obligations.

Legal and Special Events:

Legal filings such as bankruptcies, judgments, and liens can provide useful insights into the financial health and security of a company. Dun & Bradstreet credit reports provide comprehensive details, giving valuable insights into possible risks. In addition, the Special Events section highlights important events such as mergers, acquisitions, or leadership changes that could impact the company’s credit status.

Understanding the ownership structure and corporate linkages:

Understanding the ownership structure and corporate linkages can provide valuable insights into a company’s larger business relationships and potential internal risk factors. This knowledge is crucial when analyzing conglomerates or businesses with intricate subsidiary structures.

Advantages of Using Dun & Bradstreet Credit Reports

Utilizing Dun & Bradstreet’s credit reports allows businesses to:

Minimize Risk:

By getting a comprehensive knowledge of the financial well-being and stability of potential partners and competitors.

Improve Decision-Making:

By having access to extensive data, companies can make more informed choices based on data when it comes to credit and business strategies.

Anticipate Financial Stability:

Predictive analytics provide valuable insights into potential financial challenges, enabling businesses to take proactive measures.

Efficient Credit Processes:

The wealth of information available streamlines the credit evaluation process, saving important time and resources.

Dun & Bradstreet’s credit reports are important tools for businesses looking to navigate the intricate realm of credit and financial risk management. Through the provision of comprehensive and practical insights, these reports allow people to foster sustainable growth, ensure financial stability, and facilitate informed decision-making for businesses.

Given the ever-changing nature of markets, having access to comprehensive reports is important for businesses to make informed decisions regarding credit and financial strategies.

Thus, you may have observed the importance of understanding and maintaining a good credit score, which is crucial for securing favourable loan terms and interest rates. It explains that a credit score is a numerical representation of a person’s creditworthiness, influenced by factors such as payment history, credit duration, credit mix, and recent credit inquiries. The score ranges between 300 and 850, with higher scores indicating better creditworthiness.