In today’s rapidly advancing technological landscape, the banking sector is at the forefront of innovation, reshaping how we manage our finances. From traditional banking practices to the advent of mobile banking, artificial intelligence, and blockchain-based solutions, the banking industry is evolving to meet the ever-changing needs of customers and the market. In this article, we will delve into the top banking technology trends for 2023, focusing on mobile banking technology and exploring the latest innovations in the field.

Mobile Banking Technology

The world of banking has experienced a profound shift with the widespread adoption of mobile banking technology. More people than ever are embracing the convenience and accessibility offered by mobile banking. The integration of smartphones into our daily lives has played a pivotal role in driving this transformation. As we look to 2023, let’s explore the impact of mobile banking technology on the banking sector.

Latest Trends in Banking Technology

The banking industry is continually evolving to adapt to the changing landscape of technology and consumer preferences. Let’s delve into the latest trends in banking technology, emphasizing the significance of mobile banking, and examine how these innovations are shaping the future of banking.

Hyper Personalization in Banking

In the realm of banking, hyper-personalization is a game-changer. Customers now expect tailored digital interactions, and this demand extends to the banking sector. Highly personalized experiences not only boost customer loyalty but also drive increased sales and engagement. To achieve this, banks are embracing innovative approaches such as Banking-as-a-Service, APIs, and partnerships with FinTech companies. These collaborations enable the delivery of highly personalized banking services that cater to individual customer needs, ultimately enhancing the overall banking experience.

Artificial Intelligence in Banking

Artificial Intelligence (AI) is becoming increasingly prevalent in the banking industry. AI-powered chatbots are now a common sight, offering 24/7 customer support and personalized recommendations. The data processing capabilities of AI are harnessed for various applications, including fraud detection, credit risk analysis, and streamlining business processes. This technology enhances decision-making and elevates the quality of customer service.

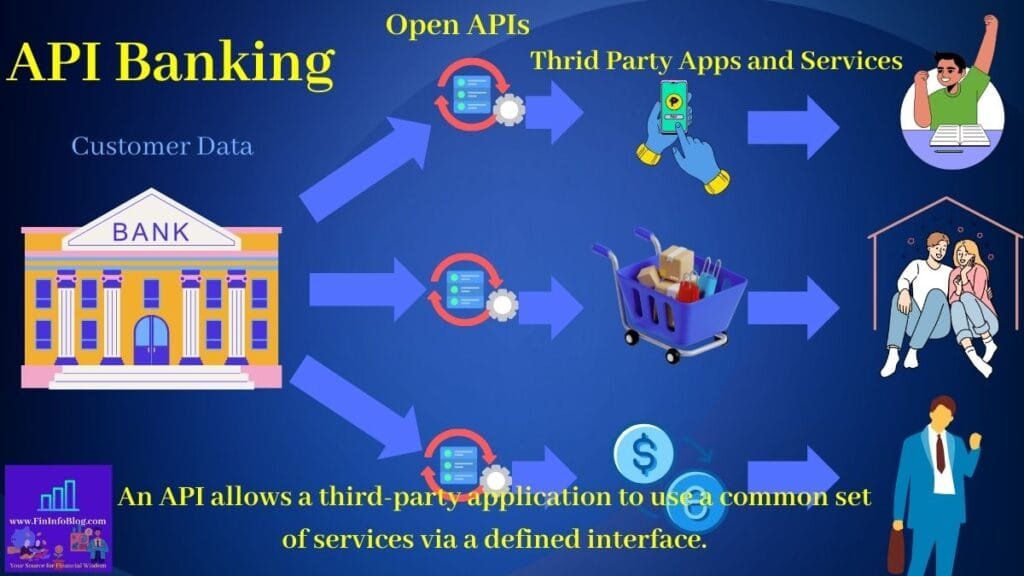

Open banking is a pivotal trend closely intertwined with mobile banking technology. It involves the sharing of customer data between banks and other financial institutions with third-party providers. Through open interfaces and APIs, modern services are made available to customers, enhancing access and convenience. Meeting customer expectations and providing personalized services remain paramount, and banks are actively working to make their services more user-friendly and tailored to individual preferences.

Payments 4.X

Payments 4.X represents a significant shift in the way financial transactions are conducted. It leverages emerging technologies such as blockchain, AI, and automation to transform traditional payment methods like debit cards and bank transfers. This trend results in faster, more efficient, and secure financial services. Mobile wallets are gaining prominence, and cashless transactions are on the rise, reshaping the way we conduct financial transactions.

Low-Code or No-Code Platforms

Simplifying the development of digital solutions, low-code and no-code platforms are becoming increasingly popular. These platforms offer pre-built components, allowing the creation of products and services with minimal programming knowledge. The adoption of these solutions is on the rise, enabling quicker product delivery, integration with core banking systems, and fostering better collaboration between business and IT departments.

Security and Legacy Systems

With the increasing digitization of financial services, security remains a top priority for banks. The digital realm opens up the risk of cyberattacks, prompting banks to invest in advanced security measures. Biometric technologies like facial recognition and iris scanning are being utilized for transaction authorization. Analytical tools are employed to detect suspicious activities and safeguard customer data privacy.

RegTech in Banking

The heavily regulated banking and financial services sector is undergoing transformation with the advent of RegTech (Regulation Technology). This technology is designed to address compliance and risk management challenges. By harnessing AI, blockchain, big data, and machine learning, RegTech automates compliance procedures and enhances risk management capabilities. It offers profound insights into compliance issues, enabling financial institutions to stay competitive and compliant in an ever-evolving regulatory landscape.

Robotic Process Automation (RPA)

Robotic Process Automation (RPA) is a technology that employs software robots or “bots” to automate rule-based, repetitive tasks in banking. This automation streamlines operational efficiency, reduces errors, and accelerates processes. The financial impact is significant, resulting in operational cost savings and improved customer experiences. For instance, loan processing, which traditionally took days, can now be completed within hours with RPA.

Blockchain in Banking

Blockchain technology, known for its decentralized and secure nature, is making inroads into the banking industry. It offers a transparent and secure platform for transactions, reducing transaction fees and enabling the use of smart contracts. Smart contracts are self-executing agreements with coded terms, automating and streamlining complex procedures, ensuring all conditions are met before a transaction is finalized.

Internet of Things (IoT)

The Internet of Things (IoT) is ushering in a new era of customized and efficient service delivery in banking. IoT devices like smartwatches and smartphones, when integrated with banking systems, allow banks to deliver personalized notifications, offers, and services based on a customer’s location and preferences. These devices transmit real-time data, empowering banks to analyze data streams and swiftly detect anomalies or suspicious activities related to customer accounts, enhancing security and customer experience.

In Conclusion

As we step into 2023, the banking technology landscape continues to evolve, driven by the latest trends in banking technology. The focus on mobile banking technology and the adoption of innovative solutions are essential for banks to meet customer demands, enhance efficiency, and deliver an outstanding banking experience. Keep a watchful eye on the developments in the digital banking sector, as technology innovations will undoubtedly shape the future of banking. Embracing these trends ensures that banks remain at the forefront of the ever-changing financial landscape.

2 thoughts on “Banking Technology :Embrace the Latest Innovations in Banking Technology for a Bright 2023”