Private Credit and M&A

In recent years, a boom in mergers and acquisitions (M&A) has been unfolding, fueled in large part by the rise of private credit. Private credit refers to non-bank lending – typically private debt financing provided by investment funds or other institutions directly to companies, outside of traditional banks or public markets. This form of financing has grown dramatically as tougher banking regulations and higher interest rates pushed corporations and buyout firms to seek alternative funding sources for deals. The result is a surge in debt-driven acquisitions, where abundant private lending is powering a new wave of takeovers and buyouts.

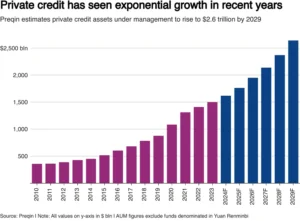

To put the growth in context, private debt (of which direct lending is a major part) has ballooned from about $557 billion in assets under management (AUM) in 2014 to over $2 trillion in 2023. Investors ranging from pension funds to insurance companies have poured money into these alternative investment vehicles, attracted by the higher yields and diversification benefits they offer compared to traditional bonds. Industry analysts expect this trend to continue – Preqin forecasts private credit AUM to reach $2.6 trillion by 2029, up from $1.5 trillion at the end of 2023. In short, private credit has gone from a niche corner of finance to a mainstream source of capital for corporate deals.

Figure: Private credit has seen exponential growth in recent years. This chart shows private credit assets under management skyrocketing from under $1 trillion in 2010 to around $1.5 trillion in 2023, with forecasts (in blue) reaching $2.5 trillion by 2029. Such growth underscores why private lenders now play a pivotal role in funding acquisitions.

The M&A deal pipeline has felt the effects of this credit windfall. With banks pulling back from riskier loans in periods of volatility (for example, in 2022 when interest rates spiked), private lenders stepped in to fill the gap. By late 2023 and into 2024, deal-making rebounded as financing conditions improved.

Companies eager to grow through acquisitions found that direct lending markets were open for business even when public markets or traditional banks were more hesitant. The stage was set for an M&A resurgence – especially in the middle-market M&A activity segment – driven by the ample supply of private credit. Below, we explore how this dynamic is playing out, from leveraged buyouts to mid-market deals, and what it means for investors and businesses.

The Role of Private Debt Financing in Leveraged Buyouts (LBOs)

One of the clearest examples of private credit’s impact is in leveraged buyouts (LBOs) – acquisitions of companies using significant borrowed money (debt) alongside equity. In an LBO, a private equity firm (or other acquirer) might contribute a portion of the purchase price in equity (cash from their fund) and borrow the rest, using the target company’s assets and cash flows as collateral. Traditionally, this debt financing came from syndicated loans or high-yield bonds arranged by banks. Today, however, private debt financing from direct lenders often fills that role, especially for deals that banks find too risky or too large for their balance sheets.

Private credit funds have become a go-to source for LBO loans. They offer speed, confidentiality, and tailored terms (such as unitranche loans, which blend senior and junior debt into one facility) that can be very attractive in competitive auctions. In fact, private credit is “continuing to grow as you see more and more private equity firms choose that route to finance their deals,” according to one credit fund CEO. This means that buyout shops are increasingly bypassing Wall Street banks and turning to direct lending specialists to bankroll acquisitions.

Notably, private lenders have shown they can write extremely large checks. While a decade ago direct lending was confined to small and mid-sized deals, today “direct lenders have grown to a point where they can legitimately compete with the syndication banks for the biggest deals,” as Greg Olafson, global head of private credit at Goldman Sachs, observed For example, in 2022 and 2023 some multi-billion-dollar buyouts were funded entirely by consortia of private credit funds when volatile markets made banks skittish. These debt-driven acquisitions illustrate how flexible private credit has become. Sponsors (the PE firms) value having reliable lenders who can execute quickly and keep transactions moving – even if it sometimes comes at a slightly higher interest cost than traditional bank loans.

Crucially, the private debt financing model has allowed many LBOs to proceed that might otherwise have stalled. During periods when bond markets or leveraged loan markets tightened, direct lenders stepped in. A case in point: when banks pulled back in 2022, direct lending funds provided a massive unitranche loan (in the billions of dollars) to finance Thoma Bravo’s acquisition of software firm Anaplan, at the time one of the largest private credit deals ever.

This kind of agility in financing gives buyout firms a “cushion” – they know that even if the public markets shut, there is a private pool of capital ready to deploy. It’s no surprise then that private equity growth trends over the last few years – including record levels of “dry powder” (uninvested capital) – have been intertwined with the expansion of private credit. Leveraged buyouts thrive on leverage, and private credit has become a critical enabler of that leverage.

How the Direct Lending Market Fuels Middle-Market M&A Activity?

While headline-grabbing mega-buyouts get attention, much of the M&A boom is happening in the middle market – typically deals involving companies with under $1 billion in enterprise value. This is where the direct lending market truly shines. Middle-market companies often lack access to cheap bond financing or large syndicated loans, making them ideal candidates for private credit. Direct lenders, such as business development companies (BDCs) and private debt funds, specialize in serving these borrowers, offering loans tailored to their needs.

In the current environment, middle-market M&A activity has been robust because financing is readily available from non-bank sources. When a private equity firm or even a strategic buyer targets a mid-sized company, they can secure funding from private credit funds relatively quickly.

Banks, which have generally pulled back from smaller corporate loans due to regulatory capital requirements, are no longer the only gatekeepers to acquisition financing. As one senior banker noted, the syndicated loan and private credit markets “are going to converge and will look more alike over time”– meaning direct lenders are now competing head-to-head with banks, even in areas once dominated by bank lending. Nowhere is this more evident than in the middle market.

For instance, Wells Fargo (a major U.S. bank) recently partnered with a private equity firm to build a direct lending business for mid-sized clients. Why? Because their corporate customers needed financing options for acquisitions and growth that went beyond what traditional bank loans could offer. As David Marks of Wells Fargo Commercial Banking put it, the goal was to give middle-market clients access to “another form of financing for their most strategic and transformational transactions,” not just to jump on the private credit bandwagon for its own sake.

In practice, this means a family-owned manufacturing company or a tech services firm looking to sell or merge can find a willing lender in the private credit arena to fund the deal. The direct lending market provides the capital that helps these transactions close.

Importantly, direct lenders often provide bespoke loan structures (like unitranche loans, mezzanine debt, or PIK-toggle notes) that suit the cash flow profiles of middle-market businesses. This flexibility can make the difference in getting a deal done. Borrowers in this segment may pay a premium for private credit – loans from private creditors “often trade at a premium to traditional syndicated loans” of a few hundred basis points– but they gain certainty of execution and often speed, which are vital in M&A negotiations. As competition heats up, middle-market acquisitions are being financed by ever-larger pools of direct lender capital, fueling consolidation across industries from healthcare to software. In short, private credit has unlocked a new level of activity in the middle tier of the M&A market, enabling deals that might not have been possible otherwise.

Institutional Investor Appetite for Alternative Investment Vehicles

The rise of private credit has been underpinned by a strong institutional investor appetite for yield and alternative assets. Pension funds, endowments, insurance companies, and wealthy individuals (through feeder funds) have all sought exposure to private credit as an alternative investment vehicle that can deliver steady income. In a world where traditional fixed-income yields were ultra-low for many years, private credit’s higher interest rates (often in the high single digits or low double digits) looked very attractive. Even as central bank rate hikes have made bonds more appealing than before, investors still value the diversification and potential upside that private debt offers.

This appetite is visible in the fundraising numbers. Private debt fundraising rebounded strongly in 2024, with $169.2 billion in capital committed to private debt funds through Q3 2024 – a pace that points to an increase over the prior year. In fact, many large asset managers are doubling down on private credit. A notable example is BlackRock, the world’s largest asset manager, which announced a $12 billion acquisition of HPS Investment Partners (a major private credit firm) in late 2024. BlackRock’s CEO Larry Fink has called private credit a “primary growth driver” for the firm’s alternatives business, highlighting how mainstream this asset class has become for institutional portfolios.

These investors are drawn not only by yield but also by the structural protections and floating interest rates typical in private loans, which can offer a cushion against inflation. Institutional investor appetite also stems from a desire to participate in the M&A boom indirectly: by financing the deals, investors can earn solid returns without taking direct equity risk. Many institutions invest through private credit funds or BDCs (Business Development Companies), which pool many loans together, or through separately managed accounts with direct lending managers. As a result, the amount of capital available for non-bank lending has surged.

It’s worth noting that with this influx of capital, some investors have broadened the scope of private credit – funding not just buyouts, but also areas like real estate loans, infrastructure debt, and specialty finance. However, corporate debt-driven acquisitions remain the marquee segment. The enthusiasm of institutional investors provides the firepower that private lenders use to support corporate borrowers. Going forward, most analysts expect allocations to private credit to continue rising as long as performance holds up. Alternative investment vehicles like these have firmly cemented themselves in the financial ecosystem, blurring the lines between traditional and alternative financing for M&A.

Private Equity Growth Trends and Impacts on the M&A Deal Pipeline

Booming private credit and booming private equity have gone hand in hand. Over the past decade, private equity firms raised record amounts of capital, leading to massive funds and intense pressure to find deals (the so-called “dry powder” issue). These private equity growth trends directly impact the M&A deal pipeline: when PE firms have money to spend, they hunt for acquisitions. But they also need willing lenders to finance those deals. Enter private credit – the timing of its surge was perfect to support the ambitions of private equity in recent years.

After a blockbuster 2021 for M&A, deal activity slowed in 2022 amid rising interest rates and economic uncertainty. Many deals were put on hold due to the financing gap as banks became cautious. By late 2023 and 2024, however, the pipeline refilled, in part because private credit stepped up. Loan volume for new M&A transactions jumped 83% year-over-year in 2024, reaching about $481 billion.

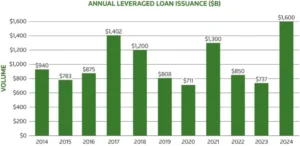

This remarkable rebound was tied to improved market sentiment and the adaptation of deal structures to higher-rate conditions – often via direct lenders offering creative financing packages. Overall leveraged loan issuance (including both bank and direct lender deals) surged to $1.6 trillion in 2024, up 117% from 2023 and the highest level since 2017. Clearly, the M&A engines are revving again, and credit is the fuel.

Figure: Annual leveraged loan issuance in the U.S. (in $ billions) from 2014 through 2024. After a dip to ~$737 billion in 2023, issuance skyrocketed to $1,600 billion in 2024 – the largest in several years – indicating a revived debt market supporting the M&A boom. This surge reflects how quickly the M&A deal pipeline reopened as private equity buyers gained confidence in financing availability.

Another important trend is the competition between private equity and strategic (corporate) buyers. When private equity firms are armed with ample funds and assured of lender support, they can outbid corporates for attractive targets. This has forced many companies to rethink their corporate acquisitions strategy.

In some cases, corporates have teamed up with PE firms or sought their own private financing to stay in the game. Private credit has been there for them too – for example, a mid-sized public company might tap a direct lender for a loan to finance an add-on acquisition, bypassing slower bond markets.

Furthermore, the presence of abundant private credit means the M&A deal pipeline can include deals that wouldn’t have been attempted before. Private equity firms are exploring larger acquisitions (sometimes clubbing together on deals or pursuing public-to-private transactions) knowing that they can call on large direct loans. The average size of private credit transactions has grown, and lenders have formed syndicates amongst themselves to handle bigger financings.

According to Reuters, even deals in the $10+ billion value range now see direct lenders bidding to provide the financingr. This is a stark change from a decade ago and represents a new era for buyout financing. The net impact is more deal flow: when financing is readily obtainable, buyers are more likely to pursue acquisitions, which keeps the pipeline of mergers and buyouts well-stocked.

Strategic Implications for U.S. Companies

For U.S. companies, the M&A boom driven by private credit has several strategic implications. Firstly, companies looking to be acquired (or to merge with a partner) may find a larger pool of potential buyers. Private equity firms backed by robust private credit financing are scanning the market for targets, including family-owned businesses and divisions of larger companies. This can be positive for sellers – more competition often means higher valuations and quicker deal timelines. A mid-sized company in, say, the manufacturing sector might receive attractive offers from PE firms that have lined up financing through direct lenders, making a sale easier and more lucrative than in the past.

On the flip side, companies that are acquirers need to be aware of the new landscape. Corporate acquisition strategy now frequently involves evaluating financing options that include private credit. If a company wants to make a strategic acquisition (for example, a tech firm buying a smaller rival), it can consider raising funds from a private credit fund to get the deal done swiftly, especially if traditional bank loans or bond issuance would take too long or carry restrictive covenants. The stigma once attached to private loans (as a last resort for those who couldn’t tap banks) has faded – today even healthy companies sometimes opt for direct loans for the convenience and certainty they provide. Executives and corporate development teams should build relationships with private credit providers just as they do with investment banks, because those relationships can be the key to unlocking a deal at the right moment.

Another implication is the competitive pressure from financial sponsors. Strategic (corporate) buyers are often competing with private equity bidders in auctions. Given that private equity has plentiful financing at its disposal, corporates must play to their strengths – such as emphasizing long-term strategic fit over short-term returns – to win deals. In some cases, corporations are partnering with private equity (through joint ventures or minority investments) to leverage the PE’s access to private credit. In other cases, they are lobbying for regulatory or board preferences for a strategic buyer versus a financial buyer. The bottom line is that U.S. businesses must navigate an M&A environment where cash is king, and thanks to private credit, cash (in the form of readily available debt) is abundant for those who know how to secure it.

Finally, companies need to consider their capital structure and resilience. Taking on significant debt to finance acquisitions can be a double-edged sword. While it enables growth, it can also increase vulnerability to economic downturns. Prudent companies are stress-testing their balance sheets to ensure that any loans – whether from banks or private lenders – remain manageable under various scenarios. In summary, private credit’s rise has expanded the strategic options for companies, but it also demands savvy decision-making to use that financing wisely amid fiercer competition.

Risks and Opportunities in Debt-Driven Acquisitions

The boom in debt-driven acquisitions brings with it a mix of exciting opportunities and cautionary risks. It’s important for investors and companies alike to weigh these factors:

Opportunities:

- Faster Deal Execution: Private credit can be deployed quickly and quietly. Buyers can seize opportunities knowing financing is less of a hurdle, which can give them an edge in negotiations. This has sped up the M&A process for many transactions.

- Customized Financing Solutions: Unlike one-size-fits-all bank loans, direct lenders often tailor debt packages to the deal’s needs (e.g. offering interest-only periods or PIK interest). Such flexibility can make previously challenging deals feasible, unlocking value through acquisitions.

- Broader Access to Capital: Middle-market companies that traditionally struggled to get acquisition financing now have more options. This democratization of credit means more businesses can engage in M&A, either as buyers or sellers, fueling overall market dynamism.

- Attractive Investor Returns: For investors in private credit funds, the M&A boom offers a chance to earn higher returns linked to these deals. When an acquisition is successful, lenders earn interest and fees often in the high single digits or more, making it an appealing asset class relative to traditional bonds.

Risks:

- Higher Leverage = Higher Risk: Loading up on debt can amplify returns in good times but also magnify losses in bad times. If an acquired company underperforms or the economy turns, highly leveraged firms may struggle to meet debt payments, leading to defaults or distress. In fact, signs of strain are showing for some borrowers – Moody’s has warned that as private lenders take a greater role, potential risks may be obscured due to lighter regulation and less transparency in this market.

- Interest Rate and Refinancing Risk: Most private credit loans have floating interest rates. Borrowers face the risk of rising rates increasing their debt service costs. Even if rates stabilize, there’s the question of refinancing – many private loans are medium-term. If credit conditions tighten in a few years, companies might find it expensive or difficult to refinance the large debts incurred now.

- Liquidity and Covenant Concerns: Private loans are generally less liquid than public debt. If a company hits a rough patch, it can be harder to renegotiate or refinance a private deal (which might be held by a handful of funds) versus a broadly syndicated one. Also, while some direct loans have covenant protections, others might be covenant-lite, potentially delaying warning signs of trouble until it’s too late. Transparency is key – analysts note the market would benefit from more data on default rates and recoveries in private credit, which currently can be murky.

- Portfolio Concentration for Lenders: From the lender’s perspective, the rush to fund M&A means taking bigger positions in single deals. A private credit fund might lend hundreds of millions to one company. If that company falters, the hit to the lender’s portfolio is significant. This concentration risk is something credit managers must manage carefully, especially as they compete to back ever-larger buyouts.

In essence, debt-driven acquisitions offer a high-reward, high-risk proposition. They enable growth and profit in an M&A boom, but all parties involved must conduct due diligence and maintain discipline. Lenders are increasingly doing deeper homework on industries and borrowers, and some are inserting stricter covenants to protect themselves.

Borrowers (the acquiring companies and the PE sponsors) are also being mindful of debt loads, sometimes even bringing in multiple lending partners to diversify funding. The opportunities are vast – more deals, new partnerships, creative financial engineering – but the system will likely be tested in the next economic downturn. How well the risks are navigated will determine if the current boom leads to long-term success stories or a hangover of troubled loans.

What This Means for U.S. Investors and Businesses

The private credit and M&A boom is reshaping the U.S. financial landscape for both investors and businesses. For investors, particularly institutional ones, it has opened up a compelling avenue to deploy capital. They can invest in private credit funds or similar alternative vehicles to earn solid yields from the interest on M&A-related loans.

This offers portfolio diversification and a way to indirectly ride the M&A wave. U.S. pension funds, for instance, benefit when they allocate to private credit and those loans perform well, as it contributes to meeting their return targets in a low-yield world. That said, investors must remain vigilant about the credit quality of deals being financed. Diligence and selection of experienced credit managers are key, as not all debt-funded acquisitions will be winners.

For businesses, the implications are twofold. On one hand, companies have more financing options and thus more strategic freedom. Ambitious mid-sized firms can consider transformative mergers because they know capital is available to back them. Entrepreneurs looking to sell their companies find plenty of buyers at the door, backed by private credit war-chests.

On the other hand, the bar for performance is raised when a company takes on significant debt. Executives must execute on growth plans post-acquisition to justify the leverage. Additionally, there’s a competitive imperative: if your industry is consolidating via debt-financed deals, standing still could mean falling behind. Every company needs to understand how accessible credit is influencing their sector – whether it means facing new competitors created by PE roll-ups or the need to pursue acquisitions just to keep pace.

In summary, the convergence of private credit and a rejuvenated M&A pipeline has created a dynamic environment in the U.S. market. It represents a significant shift in who holds the purse strings for corporate America’s growth. Non-bank lenders are now at the forefront of enabling mergers, acquisitions, and buyouts, from the middle-market to the mega-deal.

This trend has empowered buyers and enriched investors, all while requiring a new level of prudence to manage the accompanying risks. For the foreseeable future, private credit-backed M&A looks set to remain a driving force – one that U.S. investors and businesses ignore at their peril. By staying informed and adaptable, stakeholders can make the most of this debt-fueled M&A boom while preparing for the challenges it may bring The landscape of corporate finance has been forever changed, and the ripple effects of today’s private credit-funded deals will be felt in the economy for years to come.

Overall, the Private Credit and M&A Boom underscores a new era in which opportunistic capital finds innovative ways to propel growth. It’s an exciting time for deal-makers and a critical time for careful risk management – a balancing act that will define success in this evolving chapter of U.S. business history.

Top Cash Back Credit Cards 2025: Your Ticket to Earning While You Spend!

Are Banking Apps Safe? Everything You Must Know About Mobile Banking Security in 2025

Join the No-Buy 2025 Movement: A Comedic Guide to Your Shopping Detox