Table of Contents

ToggleComparing Car Loans: SBI vs. HDFC Bank

Are you planning to finance your new car but feeling overwhelmed by the complex world of banking terms? Don’t worry; we’re here to simplify things for you. In this article, we’ll break down the car loan options offered by two of India’s leading banks: State Bank of India (SBI) and HDFC Bank. We’ll cover everything from eligibility requirements to interest rates, fees, and more, making it easier for you to make an informed decision.

Car loan eligibility

When it comes to eligibility for car loans, both SBI and HDFC have some common criteria and differences you need to know.

Age Limits: To apply for a car loan, you must be at least 21 years old. However, SBI allows applications up to the age of 70, while HDFC sets the limit at 60.

Income Criteria: For salaried individuals, both banks require a minimum monthly income of ₹25,000 or an annual income of ₹3 lakh. Non-salaried individuals need a net profit or taxable income of ₹3 lakh to be eligible.

Employment Duration: Salaried applicants should have over two years in their current job, including at least one year with their current employer. Business owners should have a minimum of two years of business experience.

Car Loan Amount and Terms

Understanding the loan amount and terms is essential when considering a car loan.

Max Loan Amount: SBI offers a maximum loan amount of 48 times the monthly income for salaried individuals and 4 times the net profit for non-salaried individuals. Unfortunately, HDFC Bank has not specified this information on their website, which can make it less transparent compared to SBI.

Minimum Margin (Down Payment): The down payment, which is usually a percentage of the car’s value, is set at 10% by SBI. However, HDFC has not disclosed this information.

SBI car loan interest rate

| Term of Loans | ||

| CIC Score (CIBIL) | 3 to 5 years | Above 5 years |

| 775 & above | 9.35% | 9.45% |

| 757-774 | 9.45% | 9.55% |

| 721-756 | 9.70% | 9.80% |

| 700-720 | 9.95% | 10.05% |

| 650-699 | 10.05% | 10.15% |

| -1 | 9.45% to 9.80% | |

Interest rates play a significant role in the overall cost of your car loan.

Interest Rates: SBI provides detailed interest rates based on the CIBIL score, which measures your creditworthiness. Rates range from 9.20% to 10.15%, depending on the loan term and your credit score. On the other hand, HDFC’s rates are not explicitly stated but are reported to be between 8.50% and 14.00%.

Processing Fee: SBI offers a festive waiver of processing fees time to time, which can be advantageous. In contrast, HDFC charges a fee of 0.5% of the loan amount with certain conditions.

Prepayment Penalty in HDFC Bank.

If you plan to pay off your loan early, it’s essential to understand the prepayment penalty. SBI does not charge a penalty on amounts up to ₹25,000. HDFC, however, has a tiered penalty system based on when you close the loan, ranging from 3% to 6% of the outstanding principal.

Documentation and Turnaround Time (TAT)

The paperwork required by both banks is relatively standard, including identity and address proofs, income statements, and photographs.

However, the key difference lies in the Turnaround Time (TAT). SBI takes 2 days for urban branches and 4 days for rural branches to process your loan application. In contrast, HDFC boasts an impressive TAT of just 30 minutes, showcasing the speed advantage of private banks. Both banks give you option to apply Car Loan Online. Link of the both bank are given below:-

Apply for a car loan online from SBI and HDFC Bank

Conclusion

Choosing the right car loan involves considering various factors beyond interest rates and fees. SBI, as a public sector bank, offers clarity on the terms of its loans and a sense of reliability. On the other hand, HDFC shines in terms of efficiency and faster processing times, although it’s crucial to be aware of the various charges that could accrue if repayments are not made on time.

Whether you use a car loan EMI calculator or review the SBI car loan prepayment rules, understanding the fine print is key to making an informed decision. In conclusion, your choice between SBI and HDFC for your car loan should align with your specific needs and priorities. Take your time to evaluate all aspects and make a decision that suits you best. Happy car shopping!

Meaning of banking terms used in this blog are as under: –

Minimum Age: This refers to the lowest age limit that an individual must meet to be eligible for a particular financial product or service, such as opening a bank account or applying for a loan. For example, the minimum age for a car loan might be set at 21 years.

Maximum Age: This is the highest age limit that an individual can have to be eligible for a specific banking product or service. For instance, a bank may allow individuals to apply for a credit card up to a maximum age of 65.

Income Criteria: Income criteria specify the minimum level of earnings or income that an applicant must have to qualify for a particular financial offering. For instance, to be eligible for a loan, a bank might require a minimum monthly income of ₹25,000 for salaried individuals.

Employment Duration: This term indicates the length of time an individual is required to have been employed or in business to be eligible for certain financial products. For instance, a bank might require salaried applicants to have a minimum of two years in their current job.

Max Loan Amount: The maximum loan amount is the highest sum of money that a bank is willing to lend to a borrower for a specific financial product. This amount can vary depending on factors such as the borrower’s income and creditworthiness.

Minimum Margin: Minimum margin, often referred to as the down payment, is the initial amount of money that a borrower must contribute toward the purchase of an asset or property, typically expressed as a percentage of the total value. For example, if the minimum margin for a car loan is 10%, the borrower needs to pay 10% of the car’s price upfront.

CIBIL Score (Credit Information Bureau of India Limited Score): CIBIL score is a credit rating provided by CIBIL, a credit bureau in India. It reflects an individual’s creditworthiness based on their credit history and repayment behavior. Higher CIBIL scores indicate better creditworthiness and increase the likelihood of loan approval.

Processing Fee: This is a fee charged by a bank or financial institution to cover the cost of processing a loan application or other financial transactions. It is typically a one-time fee paid when the application is submitted.

Documentation Fee: The documentation fee is a charge for the preparation and processing of paperwork related to a financial transaction. It covers the cost of creating legal documents, agreements, and other necessary paperwork.

Prepayment Penalty: A prepayment penalty is a fee charged to a borrower who pays off a loan or a part of it before the agreed-upon repayment schedule. It is intended to compensate the lender for potential interest income lost due to early repayment.

Penal Interest: Penal interest, also known as late payment interest or default interest, is the additional interest charged by a lender when a borrower fails to make loan payments on time. It serves as a penalty for late payments.

Security: Security, in the context of loans, refers to collateral or assets provided by a borrower to secure the loan. It acts as a guarantee for the lender that if the borrower defaults, the lender can claim the collateral.

Registration Delay Charges (Delay in submission of RC book): These are charges imposed by a bank or lender when there is a delay in submitting the registration certificate (RC book) of a vehicle purchased with a car loan.

Inspection Charge: This is a fee that may be levied by a lender to cover the cost of inspecting the collateral or property offered as security for a loan, typically applicable in cases of secured loans.

Force Close Charge: A force close charge is a fee imposed when a borrower wishes to close a loan account prematurely or before the agreed-upon tenure, such as when making a full prepayment of the loan amount.

TAT (Turnaround Time): TAT represents the time taken by a bank or financial institution to process and complete a specific task or service, such as approving a loan application. A shorter TAT often indicates faster and more efficient service.

How to calculate car loan emi?

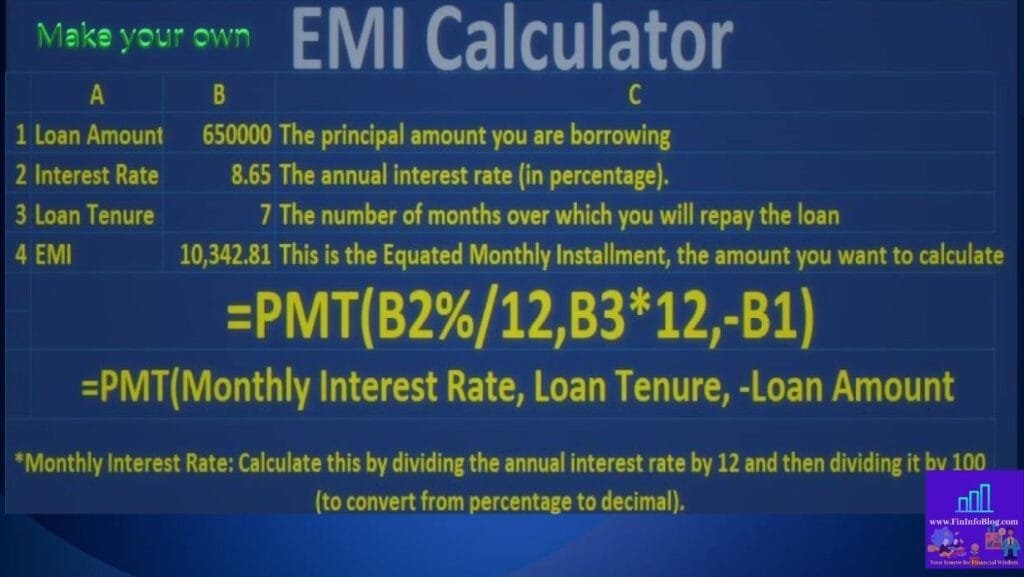

Create Your Own EMI Calculator in Excel

car loan emi calculator

- To build your custom EMI (Equated Monthly Installment) calculator in Microsoft Excel, follow these simple steps:

- Open Microsoft Excel: Start by launching Microsoft Excel on your computer.

- Set Up a Spreadsheet: In a new or existing spreadsheet, create the necessary columns for your EMI calculator.

- In cell A1, label it as “Loan Amount” and enter the loan amount in cell B1.

- In cell A2, label it as “Interest Rate” and specify the interest rate (e.g., 8.65%) in cell B2.

- In cell A3, label it as “Tenure” and indicate the loan tenure in months or years (e.g., 7 years) in cell B3.

- In cell A4, label it as “EMI,” where you will calculate and display the Equated Monthly Instalment.

- Enter the Data: Input your loan details into the respective cells.

- Loan Amount: This represents the principal amount you intend to borrow.

- Interest Rate: This is the annual interest rate expressed as a percentage.

- Tenure: Specify the loan tenure in months or years, as per your preference.

- In cell B4 type the following formula

=PMT(B1%/12,B2*12,-B1)

| EMI No. | Payment Date | Principal Payment | Interest Payment | Total Payment | Principal Remaining |

| 1 | Dec-23 | 5657.40 | 4685.42 | 10342.81 | 644342.60 |

| 2 | Jan-24 | 5698.18 | 4644.64 | 10342.81 | 638644.43 |

| 3 | Feb-24 | 5739.25 | 4603.56 | 10342.81 | 632905.18 |

| 4 | Mar-24 | 5780.62 | 4562.19 | 10342.81 | 627124.55 |

| 5 | Apr-24 | 5822.29 | 4520.52 | 10342.81 | 621302.26 |

| 6 | May-24 | 5864.26 | 4478.55 | 10342.81 | 615438.00 |

| 7 | Jun-24 | 5906.53 | 4436.28 | 10342.81 | 609531.47 |

| 8 | Jul-24 | 5949.11 | 4393.71 | 10342.81 | 603582.37 |

| 9 | Aug-24 | 5991.99 | 4350.82 | 10342.81 | 597590.38 |

| 10 | Sep-24 | 6035.18 | 4307.63 | 10342.81 | 591555.19 |

| 11 | Oct-24 | 6078.69 | 4264.13 | 10342.81 | 585476.51 |

| 12 | Nov-24 | 6122.50 | 4220.31 | 10342.81 | 579354.01 |

| 13 | Dec-24 | 6166.64 | 4176.18 | 10342.81 | 573187.37 |

| 14 | Jan-25 | 6211.09 | 4131.73 | 10342.81 | 566976.28 |

| 15 | Feb-25 | 6255.86 | 4086.95 | 10342.81 | 560720.42 |

| 16 | Mar-25 | 6300.95 | 4041.86 | 10342.81 | 554419.47 |

| 17 | Apr-25 | 6346.37 | 3996.44 | 10342.81 | 548073.10 |

| 18 | May-25 | 6392.12 | 3950.69 | 10342.81 | 541680.98 |

| 19 | Jun-25 | 6438.20 | 3904.62 | 10342.81 | 535242.78 |

| 20 | Jul-25 | 6484.60 | 3858.21 | 10342.81 | 528758.18 |

| 21 | Aug-25 | 6531.35 | 3811.47 | 10342.81 | 522226.83 |

| 22 | Sep-25 | 6578.43 | 3764.39 | 10342.81 | 515648.40 |

| 23 | Oct-25 | 6625.85 | 3716.97 | 10342.81 | 509022.55 |

| 24 | Nov-25 | 6673.61 | 3669.20 | 10342.81 | 502348.95 |

| 25 | Dec-25 | 6721.71 | 3621.10 | 10342.81 | 495627.23 |

| 26 | Jan-26 | 6770.17 | 3572.65 | 10342.81 | 488857.06 |

| 27 | Feb-26 | 6818.97 | 3523.84 | 10342.81 | 482038.10 |

| 28 | Mar-26 | 6868.12 | 3474.69 | 10342.81 | 475169.97 |

| 29 | Apr-26 | 6917.63 | 3425.18 | 10342.81 | 468252.34 |

| 30 | May-26 | 6967.49 | 3375.32 | 10342.81 | 461284.85 |

| 31 | Jun-26 | 7017.72 | 3325.09 | 10342.81 | 454267.13 |

| 32 | Jul-26 | 7068.30 | 3274.51 | 10342.81 | 447198.83 |

| 33 | Aug-26 | 7119.25 | 3223.56 | 10342.81 | 440079.57 |

| 34 | Sep-26 | 7170.57 | 3172.24 | 10342.81 | 432909.00 |

| 35 | Oct-26 | 7222.26 | 3120.55 | 10342.81 | 425686.74 |

| 36 | Nov-26 | 7274.32 | 3068.49 | 10342.81 | 418412.42 |

| 37 | Dec-26 | 7326.76 | 3016.06 | 10342.81 | 411085.66 |

| 38 | Jan-27 | 7379.57 | 2963.24 | 10342.81 | 403706.09 |

| 39 | Feb-27 | 7432.76 | 2910.05 | 10342.81 | 396273.33 |

| 40 | Mar-27 | 7486.34 | 2856.47 | 10342.81 | 388786.98 |

| 41 | Apr-27 | 7540.31 | 2802.51 | 10342.81 | 381246.68 |

| 42 | May-27 | 7594.66 | 2748.15 | 10342.81 | 373652.02 |

| 43 | Jun-27 | 7649.40 | 2693.41 | 10342.81 | 366002.61 |

| 44 | Jul-27 | 7704.54 | 2638.27 | 10342.81 | 358298.07 |

| 45 | Aug-27 | 7760.08 | 2582.73 | 10342.81 | 350537.99 |

| 46 | Sep-27 | 7816.02 | 2526.79 | 10342.81 | 342721.97 |

| 47 | Oct-27 | 7872.36 | 2470.45 | 10342.81 | 334849.61 |

| 48 | Nov-27 | 7929.11 | 2413.71 | 10342.81 | 326920.51 |

| 49 | Dec-27 | 7986.26 | 2356.55 | 10342.81 | 318934.24 |

| 50 | Jan-28 | 8043.83 | 2298.98 | 10342.81 | 310890.42 |

| 51 | Feb-28 | 8101.81 | 2241.00 | 10342.81 | 302788.60 |

| 52 | Mar-28 | 8160.21 | 2182.60 | 10342.81 | 294628.39 |

| 53 | Apr-28 | 8219.03 | 2123.78 | 10342.81 | 286409.36 |

| 54 | May-28 | 8278.28 | 2064.53 | 10342.81 | 278131.08 |

| 55 | Jun-28 | 8337.95 | 2004.86 | 10342.81 | 269793.13 |

| 56 | Jul-28 | 8398.05 | 1944.76 | 10342.81 | 261395.07 |

| 57 | Aug-28 | 8458.59 | 1884.22 | 10342.81 | 252936.48 |

| 58 | Sep-28 | 8519.56 | 1823.25 | 10342.81 | 244416.92 |

| 59 | Oct-28 | 8580.97 | 1761.84 | 10342.81 | 235835.95 |

| 60 | Nov-28 | 8642.83 | 1699.98 | 10342.81 | 227193.12 |

| 61 | Dec-28 | 8705.13 | 1637.68 | 10342.81 | 218487.99 |

| 62 | Jan-29 | 8767.88 | 1574.93 | 10342.81 | 209720.11 |

| 63 | Feb-29 | 8831.08 | 1511.73 | 10342.81 | 200889.03 |

| 64 | Mar-29 | 8894.74 | 1448.08 | 10342.81 | 191994.29 |

| 65 | Apr-29 | 8958.85 | 1383.96 | 10342.81 | 183035.44 |

| 66 | May-29 | 9023.43 | 1319.38 | 10342.81 | 174012.01 |

| 67 | Jun-29 | 9088.48 | 1254.34 | 10342.81 | 164923.53 |

| 68 | Jul-29 | 9153.99 | 1188.82 | 10342.81 | 155769.54 |

| 69 | Aug-29 | 9219.97 | 1122.84 | 10342.81 | 146549.57 |

| 70 | Sep-29 | 9286.43 | 1056.38 | 10342.81 | 137263.13 |

| 71 | Oct-29 | 9353.37 | 989.44 | 10342.81 | 127909.76 |

| 72 | Nov-29 | 9420.80 | 922.02 | 10342.81 | 118488.96 |

| 73 | Dec-29 | 9488.71 | 854.11 | 10342.81 | 109000.25 |

| 74 | Jan-30 | 9557.10 | 785.71 | 10342.81 | 99443.15 |

| 75 | Feb-30 | 9625.99 | 716.82 | 10342.81 | 89817.16 |

| 76 | Mar-30 | 9695.38 | 647.43 | 10342.81 | 80121.78 |

| 77 | Apr-30 | 9765.27 | 577.54 | 10342.81 | 70356.51 |

| 78 | May-30 | 9835.66 | 507.15 | 10342.81 | 60520.85 |

| 79 | Jun-30 | 9906.56 | 436.25 | 10342.81 | 50614.29 |

| 80 | Jul-30 | 9977.97 | 364.84 | 10342.81 | 40636.32 |

| 81 | Aug-30 | 10049.89 | 292.92 | 10342.81 | 30586.43 |

| 82 | Sep-30 | 10122.34 | 220.48 | 10342.81 | 20464.09 |

| 83 | Oct-30 | 10195.30 | 147.51 | 10342.81 | 10268.79 |

| 84 | Nov-30 | 10268.79 | 74.02 | 10342.81 | 0.00 |

| Total | 650000.00 | 218796.29 | 868796.29 | 29703242.79 |

How to calculate car loan interest?

Let’s take an example:

Principal Amount: ₹650,000.00, Loan Interest Rate: 8.65%. Then the monthly interest will be:

Monthly interest amount = Principal × (Interest Rate % / 12). That is, ₹650,000.00 × (8.65% / 12) = ₹4,685.42.

what is the interest rate on a car loan?

Interest rate of other banks’ car loan may be compared by visiting their official website or nearest branch. Website links of some reputed banks are given below: –

- SBI

- Axis Bank (Know about Axis Bank Car Loan)

- PNB

- BOB

- Indian Bank (Currently, Indian Bank offers the lowest interest rate among all banks.)

What is the difference between monthly interest and EMI?

| Criteria | Monthly Interest | EMI (Equated Monthly Installment) |

|---|---|---|

| Components | Only includes the interest charged on the loan balance. | Includes both the interest charge and the principal repayment. |

| Variability | Can vary with a variable interest rate loan; decreases over time for a fixed rate. | Constant each month, combining interest and principal in a fixed ratio. |

| Interest Rate | The rate itself remains constant for a fixed-rate loan. | Calculated using the interest rate, but the interest portion decreases over time. |

| Principal Repayment | Does not include any principal repayment. | Part of the EMI goes towards repaying the loan principal. |

| Purpose | To calculate the cost of borrowing money for that month. | To calculate the total monthly payment required to repay the loan over its tenure. |

| Amortization | Not applicable, as it only accounts for interest. | EMI payments contribute to loan amortization, gradually reducing the principal. |

| Payment Amount | Changes as it’s based only on the remaining loan balance. | Remains the same throughout the loan period for ease of budgeting. |

| Loan Tenure Impact | Decreases as the outstanding loan balance decreases. | Remains constant; early in the tenure, more goes to interest, later more to principal. |

How to get a Car Loan?

- To secure a car loan, follow these steps while keeping in mind the specifics of lenders like SBI and HDFC Bank:

- Evaluate your car loan eligibility: Ensure you meet the age and income criteria set by the bank, like the minimum ₹25,000 monthly income requirement for SBI and HDFC.

- Understand the interest rates: Use a car loan EMI calculator to understand how the interest rate on a car loan affects your payments. SBI and HDFC’s rates can vary, often influenced by your creditworthiness as reflected by your CIBIL score.

- Compare car loan rates: Check online for the most competitive rates. SBI car loan interest rates, for example, might differ from those offered by HDFC.

- Calculate your car loan EMI: Tools like the car loan EMI calculator can help you estimate monthly payments based on the SBI or HDFC car loan interest rate.

- Gather necessary documentation: Be prepared with your income proof, identity, and residence documents, as required by both SBI and HDFC for a car loan.

- Apply online or in-person: Opt for a car loan online application for convenience or visit a branch of your preferred bank.

- Understand prepayment terms: Be aware of hdfc car loan preclosure charges or SBI’s prepayment terms to avoid any penalties.

- Finalize the loan agreement: Once approved, complete the paperwork, agree on the loan terms, and get ready to buy your car.

- Remember, whether you’re dealing with a public sector giant like SBI or a private player like HDFC, clarity on terms and diligent preparation can steer you towards the best car loan option for you.

How to close the loan in HDFC Bank Car Loan?

Closing a car loan early can be financially advantageous in certain situations. Here are some points to consider:

- Interest Savings: The most significant benefit of closing a car loan early is the potential savings on interest. Loans are often front-loaded with interest, so the earlier you pay, the more you save on interest payments.

- Credit Score Impact: Paying off a loan early could positively affect your credit score by lowering your debt-to-income ratio. However, make sure you don’t close your only installment account, as having a mix of credit types can benefit your credit score.

- Financial Freedom: Being debt-free brings peace of mind and financial freedom. It eliminates monthly EMI obligations and frees up cash flow for other investments or savings.

- Prepayment Penalties: Check if your lender charges any prepayment penalties. If the penalty is too high, it might offset the interest savings from closing the loan early. For example, HDFC car loan preclosure charges can range from 3% to 6% of the outstanding principal.

- Emergency Fund: Ensure that paying off the loan does not deplete your emergency fund or savings meant for unforeseen expenses.

- Investment Opportunities: Compare the interest rate on your loan with potential investment returns. If you can invest money at a higher return than the interest rate of your loan, it might be better to invest rather than close the loan early.

How to close the car loan in SBI ?

As mentioned above, the foreclosure of a car loan is easier and more tension-free with SBI than with HDFC.

We hope this guide has provided you with clarity and confidence in navigating the complex world of car loans. Whether you choose SBI or HDFC Bank, make sure it’s a decision that moves you closer to your dream car, without compromising your financial health.

Follow us on Youtube Car Loan : SBI Vs HDFC Bank